Blue Dart’s Quarter 3 profit soars 30%

Revenue up by 21%; the EBITDA margin 16.8 %

New Delhi, January 28, 2022: Blue Dart Express Limited, South Asia's premier express air and integrated transportation & Distribution Company, declared its financial results for the quarter ended December 31st, 2021, at its Board Meeting held in Mumbai.

The company posted ₹1,222 million profit after tax for the quarter ended December 31st, 2021 (previous year, profit after tax for the corresponding quarter was ₹938 million). Revenue from operations for the quarter ended December 31st, 2021 stood at ₹12,548 million with a growth of 21% over the same quarter from the previous year. EBITDA for the quarter is ₹ 2,117 million, a growth of 15% over the same quarter last year. EBITDA margin stood at 16.8%,

Moreover, Blue Dart’s strong financial performance over the preceding quarters have paved the way for the Express Logistics Provider’s credit rating to be reviewed by the ICRA as well as India Ratings and Research to AA+. True to its promise of being an Investment of Choice, the company has also proposed to reward shareholders with an interim dividend of ₹25/- (Rupees Twenty Five) per share, which will be paid in February 2022.

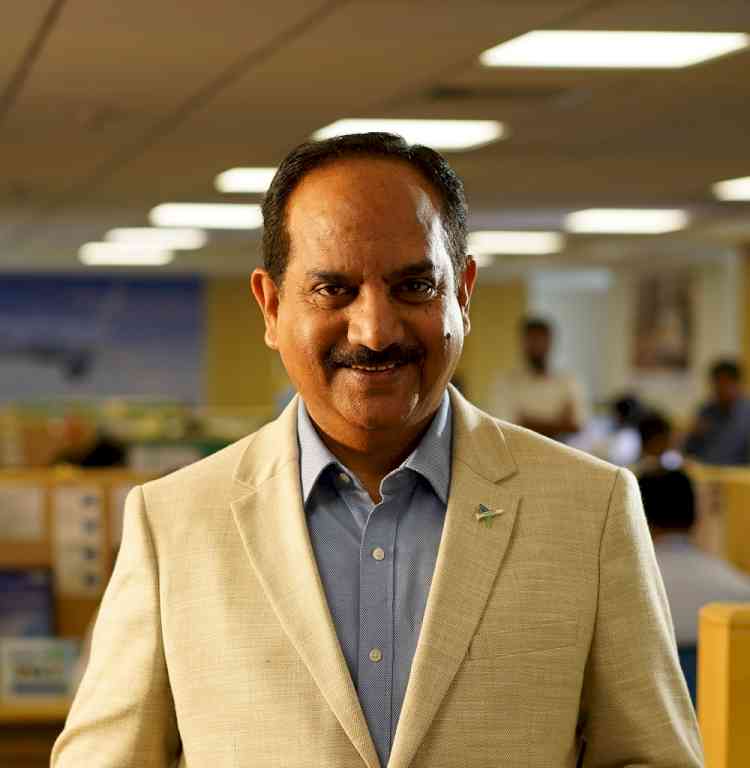

Balfour Manuel, Managing Director, Blue Dart says, “Our results reflect our efforts in continuing to remain a Provider of Choice, Employer of Choice and an Investment of Choice. The company has witnessed strong growth during Q3 of FY21-22 owing to heightened business activity from key industry verticals. I am pleased to share that the Board has announced payment of dividends to our shareholders. While the nascent stages of the third wave of the pandemic had begun to take shape towards the end of the quarter, Blue Dart’s succinct focus on delivering excellence, driven through innovation and digitisation were the main contributors to our profit margin. Apart from this, growth in demand due to the festive season, our ability to provide incomparable service quality despite a surge in volumes and our extensive reach has helped us remain a ‘Customer Trusted Brand’. We continue to invest in our capabilities in order to fulfil our role as the Nation’s Trade Facilitator.”

Speaking about the future outlook, he says, “While economic indicators, towards the end of the quarter, pointed towards green-shoots emerging in the economy, the surge in cases due to new variants of the coronavirus indicate a slow-down in recovery. However, we remain cautiously optimistic for what the future holds, especially as we work towards building a sustainable business that stands to benefit our stakeholders by providing them with responsible solutions that safeguard our planet.”

cityairnews

cityairnews