Canara Bank launches special gold loan business vertical

Gold loan for agriculture, agri-allied sectors, medical and personal emergencies and over draft facilities against gold

Chennai: The current pandemic has changed the socio-economic order of the country and managing everyday expenses, business continuity, health and family care are a challenge for many. Canara Bank, the fourth largest Public Sector Bank in India, has identified the emerging financial needs of customers and the need to support their livelihood in view of the current challenges and uncertainties. In order to address these needs and to provide hassle free credit, the Bank has launched a Special Business Vertical dedicated for Gold Loans

The Bank’s Gold Loan products are designed keeping in mind the need for quick, hassle-free experience for customers with low interest cost. The loans will help the customers with the much needed liquidity to revive their business activities and to bring back normalcy to their lives. With this objective, the Bank has also launched a special Gold Loan campaign till 30th June 2020 with an interest rate as low as 7.85% per annum.

The credit can be utilized for different purposes, such as expenses for agriculture and allied activities, business needs , health emergencies, personal needs etc among numerous other requirements .

The loan facility can be availed from all designated branches pan India.

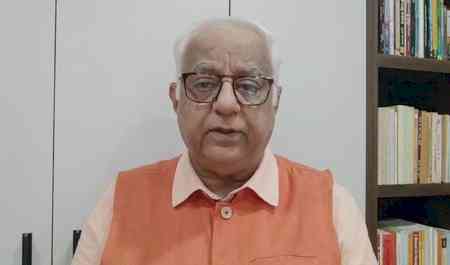

Mr. D Vijay Kumar, General Manager, Canara Bank said, “Gold, a precious commodity, is widely held by Indians as family asset in the form of jewellery and coins, however seldom leveraged for monetary requirements. In times of need, this asset can be utilized to avail credit to support emergency cash requirements”.

Mr. D Vijay Kumar added, “We understand the depth of the issues our customers are currently facing due to Covid 19 pandemic and they are in need of immediate credit support to meet their emergency needs. Hence special Gold Loan products are designed keeping in mind the challenges faced by the customers affected by Covid 19 pandemic and these products come with lower rate of interest (7.85% /annum), minimum turnaround time (TAT) and high flexibility to meet their credit needs”. The loans are payable within a period of one to three years with flexible repayment options.

cityairnews

cityairnews