Comment from Payments Council of India on RBI’s proposal to extend online payment aggregator norms to offline players

“It is a good step, and we welcome this. Undoubtedly, RBI wants to see that the Indian consumers are protected, payment systems are secured and all are regulated through single, standard regulation. Hence, almost all ecosystem players in all sectors or space, wherever there is a money transaction involved (for payments) and which were till date out of RBI’s ambit, are being proactively brought under a single regulation. As our economy turns more towards digitalisation, going ahead, the lines between customers using payment aggregators for online payments and customers using payment systems for physical, offline payments for in shop transactions, will blur, and in some cases, it has already blurred to a greater extent. I think it would be a good idea to have a single regulation/licensing for all players for the same,”

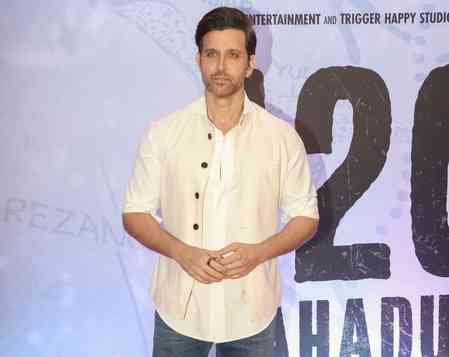

Vishwas Patel, Chairman, Payments Council of India and ED, Infibeam Avenues Ltd.

City Air News

City Air News