Creditas Solutions unveils India’s first holistic digital collections and recoveries platform – Ethera

Ethera is a quantum leap in technology that helps lenders recover loans sans human intervention

New Delhi: Creditas Solutions, India’s leading financial technology company for delinquency management, has announced the launch of Ethera. Ethera is India’s first and only holistic digital debt collections and recoveries platform for banks and financial institutions.

The platform combines predictive and prescriptive analytics, state of the art Machine Learning algorithms and decision intelligence based marketing strategies that resolve problems traditionally faced by banks in the area of delinquency management. It offers a sophisticated customer resolution process for lenders by combining delinquency detection, financial literacy, debt collection and recovery services – all without any human intervention.

Ethera collects data from multiple sources, cleanses it, and further enriches it to understand the borrower’s financial behaviour and segments them basis their credit profiles. It then intelligently creates personalized communication campaigns for each segment by calibrating for optimal content, time, channel, frequency, and preferred language. The result – radically improves engagement rates with customers. Further, all major Indian vernacular languages are supported by the Ethera platform.

For lenders, Ethera holds the promise of new-age technology that cannot only drive up NPA resolution rates but also reduce burdens, such as complex logistics of managing field and customer service agents, manual management of multiple portfolios, and data management.

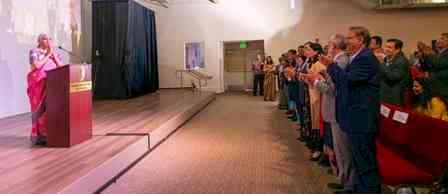

Speaking at the launch, Anshuman Panwar, Co-founder of Creditas Solutions, Given the inefficiency inherent in traditional manual collections, Creditas has developed Ethera - a fully-integrated platform for automated collections by banks. This is in line with our vision to transform the financial sector in India by deploying new-age solutions that enhance delinquency management capabilities for lenders while at the same time helping borrowers re-enter the credit mainstream in a transparent and humane fashion. The best part is that Ethera has been designed specifically to comply with the banking rules and regulations in the country and is an extremely cost-effective and scalable solution for all financial institutions”

cityairnews

cityairnews