FADA Releases December’23 and CY’23 Vehicle Retail Data

The Federation of Automobile Dealers Associations (FADA) today released Vehicle Retail Data for Dec'23 and CY’23.

Hyderabad/New Delhi, January 8, 2024: The Federation of Automobile Dealers Associations (FADA) today released Vehicle Retail Data for Dec'23 and CY’23.

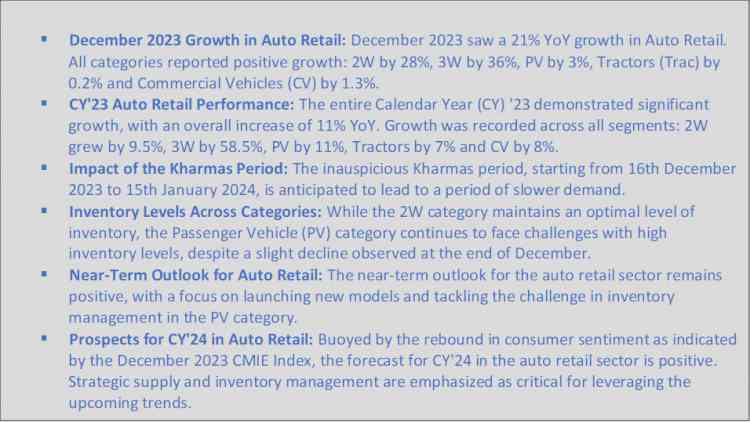

Commenting on December’23 and CY’23 Auto Retails, FADA President, Manish Raj Singhania said, “December'23 was an overall good month for Indian Auto Retail, as total retails during the period saw a growth of 21% YoY. All categories closed in green, with 2W, 3W, PV, Trac and CV growing on a YoY basis by 28%, 36%, 3%, 0.2% and 1.3% respectively.

Similarly, for CY'23, the year ended with double-digit growth as total retails during the year saw an increase of 11% YoY. Here also, all categories closed in green, with 2W, 3W, PV, Trac and CV growing on a YoY basis by 9.5%, 58.5%, 11%, 7% and 8% respectively.

In the 2W category, key drivers included an abundance of marriage dates and the distribution of harvest payments to farmers, which enhanced purchasing power. Additionally, the availability of a wide range of models and variants, coupled with favourable weather conditions and a generally positive market sentiment, contributed to this robust growth. Enhanced product acceptance, particularly among the youth, and lucrative financial options, coupled with the anticipation of price increases in January 2024, spurred purchases.

The CV category experienced positive growth as increased industrial activity and infrastructure development continued to fuel demand for M&HCVs. The bus segment also saw a rise, particularly in tourism and transportation, aided by orders from various state transport departments. Additionally, robust liquidity in rural areas and the financial boost from crop sales supported customer purchases, although retail cases remained somewhat subdued despite some pre-buying in bulk.

In the PV category, SUVs in particular saw strong demand, with extended waiting periods for key models. This surge was fuelled by aggressive year-end promotions and the introduction of new models. However, a significant concern was the high inventory levels, reflecting over-supply. This ongoing issue of high PV inventory, despite a slight decrease by the year's end, remains a critical area for OEMs to address, emphasizing the need for further moderation in inventory management."

City Air News

City Air News