In safety of bankers and customers and to avoid banks becoming hub of corona infection, adopt 5 Day working: AIBOC

Most reports say that contact tracing of infected persons have revealed that most have visited bank branches

Dharamshala: According to the different news reports across the country, Banks are turning out to be corona hotspots causing the infection as large numbers come into contact there. The incessant footfall is a matter of concern as it may proliferate the chain of infection. Most reports say that contact tracing of infected persons have revealed that most have visited bank branches.

This is being noticed that few state governments have reacted quickly over it to restrict banking days to 5 days a week . The latest being the government of West Bengal which took a decision on Monday. “All banks in West Bengal will remain closed on Saturdays and Sundays and the banks will maintain a five-day week,” said the state government on Monday. It added that the customer services will be provided on working days from 10 am up to 2 pm. ... All offices, transport services will be shut down on those two days, Home Secretary Alapan Bandyopadhyay said. Stating that community transmission of COVID-19 has been recorded in a few areas in West Bengal, the Mamata Banerjee government announced a complete lockdown across the state for two days every week to stem the spread of the disease.

Few other State Governments – Tamil Nadu, Kerala and Karnataka, have also implemented this realising the potential of the spread of the virus through bank branches. It is high time that Indian government should take this decision to avoid contamination of CoronaVirus through bank branches.

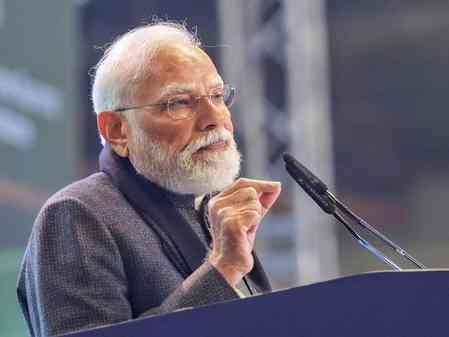

Reacting over it ,Deepak Kumar Sharma, Sr. Vice President, All India Bank Officers’ Confederation and President, All India State Bank Officers’ Federation said, “With the announcement of Unlock 1.0 and Unlock 2.0, there has been a surge in footfall in the bank branches, increasing the contact of population with the staff and the elevated risk of contagion to each other. Consequently, there has been a surge in the number of bankers who have been infected and many have succumbed to the virus. While every other sector in the society has been asked to restrict the duration of business/functioning to avoid proliferation of infection, banks are insisted upon to work throughout the week at 100% strength in most states.”

Requesting the government to act on it Sharma said, “A plausible solution will be to allow functioning of banks for 5 days in a week. Adequate time will be available for fumigation and sanitization of bank premises, which will make the bank branches safer. Thus, it will reduce the chances of infection both to the bankers and the customers, breaking the chain of infection.”

While talking here, Deepak added that in this background, it is necessary that there is a need for striking balance between making available essential banking services and avoiding spreading of virus, albeit keeping in mind the safety of both the bankers and customers as well as to avoid banks becoming a hub of infection. A five day working should be replicated across the country with immediate effect.

Restricting Banks to function for 5 days in a week will not have any adverse impact on the banking service as ATMs, Cash Deposit Machines, Cheque Deposit Machines and Internet Banking/Digital Banking channels are available. By now, customers are well acquainted with their usage. In fact, restricting banking for 5 days will pave the way for further penetration of electronic/digital banking which will, over a period, result in less banking, avoiding physical contact at bank branches and breaking the chain of infection in addition to making banking available at their own convenience.

He said that today, the country has more than 10,77,000 positive cases with daily addition of over 38000. The situation has become alarming and there is an immediate necessity to break the chain.

Arvind Sharma

Arvind Sharma