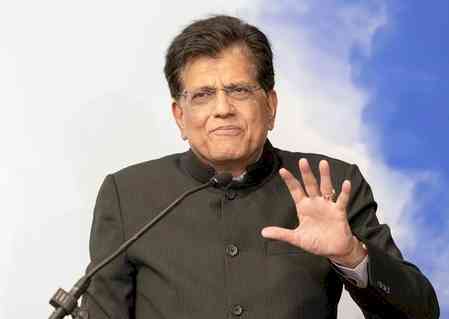

Income Tax Act must be replaced by Direct Tax Code: Chidambaram

The government must replace the Income Tax Act by the Direct Tax Code as it claims that it has dumped all old legacies, former Finance Minister P. Chidambaram said on Monday.

New Delhi, March 28 (IANS) The government must replace the Income Tax Act by the Direct Tax Code as it claims that it has dumped all old legacies, former Finance Minister P. Chidambaram said on Monday.

Participating in the debate on the Appropriation Bill and the Finance Bill 2022 in the Rajya Sabha, he said that the IT Act has 298 sections if one does not count the suffixes like ABC to the sections and 14 schedules and many amendments have been made to the earlier provisions.

Reiterating that the government should replace the IT Act with the Direct Tax Code, he said that the Act's Sections 11 and 12, which provide exemptions for charity are so cumbersome that any person will say that instead of doing charity, he or she will pay the taxes as the sections are getting complicated year after year.

"If you really think that that trusts and charity have a place in this country, let them function with a reasonable degree of independence and light regulations as burdensome provisions do not allow for charity," the Congress member said.

He also said that the concept of accreted income is very regressive, as if the exemption is cancelled under section A12A or 12AA, the entire income which is exempted from the past several years is now deemed as accreted income and one will have to pay tax on it.

About 'Faceless Assessment', Chidambaram said that in earlier systems, the officer used to known the assessee's history, has all the records and knowledge, but under this system, no one knows who the officer is.

The new provisions under the Finance Bill says that if any income has escaped assessment, the officials, instead of three years, now can review the income up to the last 10 years, he said, adding that this is a regressive provision and leads to creating hardship and a great amount of litigation.

RJD member Manoj Kumar Jha said that prosperity is not trickling down but poverty and he also raised the issue of the privatisation of public sector undertakings and the growing unemployment in the country while NCP's Praful Patel called for cryptocurrency to be tackled more aggressively and possibly can be used as a tool to lure common people by scammers.

BJP's Sushil Kumar Modi Acongratulated Finance Minister Nirmala Sitharaman for 30 per cent surcharge on earnings from cryptocurrency, which he termed "gambling", "lottery", and "a type of horse racing" and sought for even greater taxes in the future, citing that Japan had a 55 per cent tax on earnings from cryptocurrency.

Congress' Shaktisinh Gohil questioned tax provisions under the Bill along with the retrospective application of these provisions. Noting that custom duties for solar are proposed to be raised to 40 per cent, he asked the government how this will help the country in developing green energy.

The debate remained inconclusive and will be resumed on Tuesday, along with the Finance Minister's reply.

IANS

IANS