NCR witness 111 per cent jump in new launches

With 43% share, mid-segment housing saw the maximum new launches in the quarter

Delhi NCR market has performed much better than all other major cities in terms of new launches as the region witnessed a jump of 111% in Q1 2021 over Q4 2020. The next close city is Chennai that saw a jump of 74% in the same period, and Pune with 57%. According to JLL Q1 Residential Market Update - Q1 2021 report, “The markets of Delhi NCR and Chennai witnessed a substantial increase in launch activity during the quarter. New launches are still at 84% when compared to the pre-Covid levels of Q1 2020. Developers across the markets under review remain focused on the completion of under-construction projects and clearing their existing inventory.”

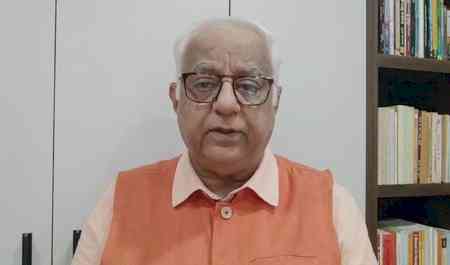

Many realtors point this change to the increasing confidence in the market, reflected in the sales figures. According to the JLL report, recovery in NCR was 92% of pre-COVID levels, and sales volume in Q1 2021 increased to 23% over Q4 2020. “The continued increase in sales indicates that demand and customer confidence is returning to the market; this is due to historically low home loan interest rates, stable housing prices, attractive payment schedules and freebies from developers, as well as government incentives. The start of the vaccine campaign has also helped to attract consumers back to the market,” says Ashok Gupta, CMD, Ajnara India Ltd.

There were 33,953 new residential units launched in the first quarter of 2021, up 27% from the previous quarter. With 69 per cent of new launches in the sub Rs 1 crore categories in Q1 2021, the growth focus on mid and affordable segments continues. Harvinder Singh Sikka, MD, Sikka Group feels that “Stamp duty reductions, more home loan rate reductions by most banks, and continuing discounts and deals have helped the residential sector make a successful comeback. Several new projects were launched in the October-December timeframe, fuelled by strong sales and positive consumer sentiment.”

Compared with Q1 2020, NCR added approximately 6,750 units in Q1 2021, a Y-o-Y increase of 9%; out of the total, approximately 52% of the new supply was in the affordable segment, according to ANAROCK's Q1 2021 data. The data also revealed that the top 7 cities saw around 62,130 new homes launched in Q1 2021 (as opposed to 41,220 units in Q1 2020) - a significant increase of 51% Y-o-Y. “With improved demand and supply in the affordable housing market, the real estate sector, which has been going through a rough patch for the past few years, is gaining traction in Delhi-NCR. In 2020, affordable housing accounted for 40% of demand. Nearly 38 per cent of the overall affordable housing demand in the country came from Delhi-NCR. Gurugram accounted for 32 per cent of total demand in the Delhi-NCR region. Homebuyers have been much more circumspect in their decisions. There is an increasing preference for affordable housing premium projects built by developers with impeccable track record. The new launches by established developers, who have the capability to execute high-quality products, are thriving in the post-covid period,” says Mr. Pradeep Aggarwal, Founder & Chairman, Signature Global, and Chairman, National Council on Affordable Housing, ASSOCHAM.

With 43% share, mid-segment housing saw the maximum new launches in the quarter, while the affordable housing segment accounted for 30%. According to the Anarock data, the supply of luxury housing (priced >INR 1.5 Cr) also rose by 31% in Q1 2021 against the corresponding period in 2020. “Throughout 2021, housing affordability is expected to remain extremely favorable. If the current perks and benefits continue, we should expect more development in the coming quarters. The uncertainty surrounding employment and income stability is expected to decrease in the coming quarters, based on the expected economic growth trend. Increased consumer trust will have a direct positive effect on the housing market. Maximum demand would be driven by end-users,” says Kushagr Ansal, Director, Ansal Housing.

cityairnews

cityairnews