Pendency of Direct Tax CIT appeals: Union Minister writes to MP Arora

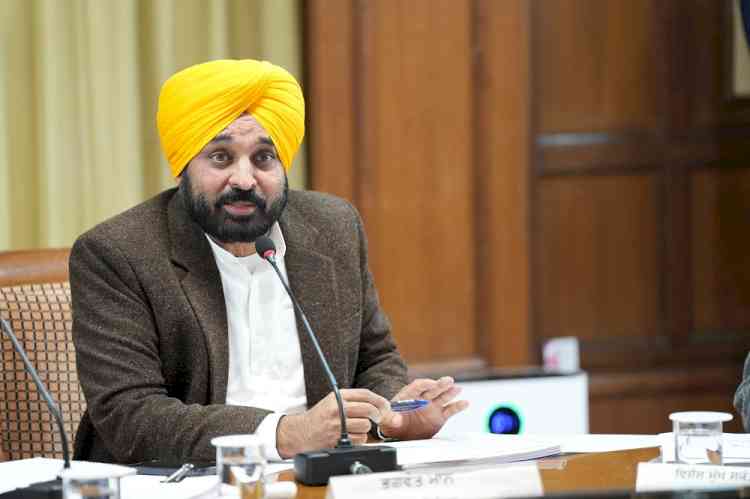

MP (Rajya Sabha) from Ludhiana Sanjeev Arora has received an official communication from the Union Minister of State for Finance Pankaj Chaudhary with regard to the large numbers of pendency of Direct Tax appeals at the first appellate level.

Ludhiana, September 17, 2024: MP (Rajya Sabha) from Ludhiana Sanjeev Arora has received an official communication from the Union Minister of State for Finance Pankaj Chaudhary with regard to the large numbers of pendency of Direct Tax appeals at the first appellate level.

Giving this information here on Tuesday, Arora said the Minister’s letter reads that “I would like to draw your attention to the matter raised by you during Zero Hour in Rajya Sabha on August 5, 2024, in which you have mentioned about the pendency of cases in the Income Tax Department.”

The Minister’s letter further mentioned that the issues raised by Arora regarding the large numbers of pendency of Direct Tax appeals at the first appellate level have been noted. During the fiscal year 2023-24, 111,282 appeals have been disposed of at the first appellate level. However, reducing the pendency at the first appellate level still remains a priority area.

Further, the letter reads that in this regard, various measures suggested by Arora have been examined. Section 250 (6A) of the Income Tax Act, 1961 prescribes a time limit of one year. However, as mentioned, the time limit prescribed is advisory in nature due to the quasi-judicial nature of the functions of the Commissioner (Appeals). Further, it may be clarified that the requirement of payment of 20% of the demand before filing an appeal is not mandatory. If an assesse desires that he should not be treated as a defaulting assesse in respect of the outstanding taxes, he may apply before the Income Tax authorities for stay of the demand till disposal of the first appeal on payment of 20% of the disputed demand. Also, this amount of 20% may be further reduced by the concerned PCIT/CIT depending upon the facts and circumstances of the case.

The Minister mentioned in his letter that various steps are being taken to clear the pendency of cases at the first appellate stage. Guidelines have been issued by the Commissioner of Income Tax (A/AU) and Additional/Deputy Commissioner of Income Tax (Appeals) regarding preliminary hearing/premature disposal of appeals in the following circumstances- cases involving demand exceeding one crore rupees, or cases where directions to this effect have been issued by the Courts, or cases where the request is made by a senior citizen and/or very senior citizen, or any other case of genuine hardship.

Arora said the Minister further stated in his communication that 100 posts of Additional/ Deputy Commissioner of Income Tax (Appeals) have been created and are fully functional. Dispute Resolution Committees have been constituted to settle certain categories of disputes. The target for disposal of first appeals during the FY 2024-25 has been enhanced through the Central Action Plan for the FY 2024-25 for various categories of First Appellate Authorities with emphasis on disposal of old and bulky appeals. Efforts are also being made to meet the need for speedy disposal of cases at the first appellate level by increasing the manpower at the first appellate level.

It may be mentioned here that while raising the issue during Zero Hour in Rajya Sabha on August 5, 2024, Arora had expressed his deep concern regarding the significant backlog of appeals pending before the Commissioner of Income Tax Appeals in India. He had stated that the current situation is worrisome because as of April 2024, a staggering number of five lakh appeals remain unresolved with CIT, with the majority of these lodged within the recent implemented faceless appellate system. To address the critical situation, he had urged, to consider his suggestions for strengthening the legal framework and providing taxpayer relief measures. He had stated that the current pendency crisis discourages taxpayer compliance and undermines the integrity of the tax system.

City Air News

City Air News