Pricol reports Revenue from Operations at 1336.15-Cr for its Standalone Operations for FY21 with a growth of 17.3 per cent over FY 20

Total Income stood at INR 1397.81-cr in FY21 as against INR 1212.96-cr in FY20

Coimbatore: The Board of Directors at Pricol Limited (BSE: 540293; NSE: PRICOLLTD), one of India’s leading automotive component and precision engineered product manufacturers, today approved the audited financial results for the quarter and year ended on March 31, 2021.

FY 2020 - 2021

Total Income stood at INR 1397.81-cr in FY21 as against INR 1212.96-cr in FY20.

Revenue from operations for the year ended March 31, 2021 stood at INR 1336.15-cr as compared to INR 1139.05-cr in FY20.

The Company’s Earnings before Interest, Tax, Depreciation and Amortization (Operational EBITDA) stands at INR 178.00-cr in FY21, as against INR 97.78-cr in FY20.

Profit Before Tax (PBT) stood at INR 46.52-cr for FY21 as compared to a loss of INR 216.72-cr in FY20. Including exceptional item of INR 190.72-cr.

Profit After Tax (PAT) stands at INR 14.60-cr in FY21 as against a loss of INR 212.88-cr in FY20.

Q4 (2020 – 2021)

Total Income stood at INR 438.19-cr in the quarter ended March 31, 2021 as against INR 286.88-cr in the corresponding quarter in FY20.

Revenue from operations for the fourth quarter of FY21 stood at INR 420.94-cr as compared to INR 263.39-cr in the fourth quarter of FY20.

The Company’s Earnings before Interest, Tax, Depreciation and Amortization (Operational EBITDA) stands at INR 57.42-cr for the January – March 2021 quarter, as against INR 38.41-cr in January – March 2020

Profit Before Tax (PBT) stood at INR 26.76-cr for the fourth quarter of FY21 as compared to a loss of INR 122.48-cr in the fourth quarter of FY20. Including exceptional item of INR 127.03-cr.

Profit After Tax (PAT) stands at INR 2.91-cr in Q4 (2020 – 2021) as against INR (120.76-cr) in Q4 (2019 – 2020).

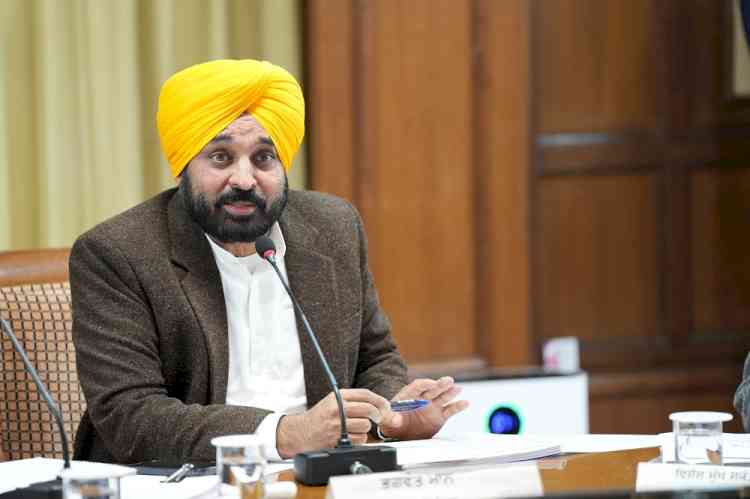

From the desk of the Managing Director:

Commenting on the company’s performance, Mr. Vikram Mohan, Managing Director, Pricol Limited said, “Our results are in line with our expectations and an outcome of our sustained efforts to reduce costs, increase productivity and enhanced market share for our products. Our growth for FY 21 has been higher than the growth of the corresponding segments of the market which has been mainly driven by introduction of new products as well as increased share of business from our customers on account of sustained performance and tight cost control. The impact of the first wave of Covid-19 and the subsequent lockdown had a major impact on the company’s performance in Q1 FY 21. Whilst we were able to bounce back very strongly; steep increase in commodity prices had an impact on the EBITDA of the company in Q4 FY 21. As our company is highly dependent on import of electronic child parts; the global shortage of ICs resulted in higher raw material prices and loss of production due to non-availability of select ICs in Q4 FY 21. Nevertheless, we remain bullish about the long term prospects for the company since we have heavily invested in technology and in capacity building in the prior years compounded by the efforts on increasing efficiency and productivity, as well as thrust on exports has helped the company launch new products and increase its market share and this will have a favorable long term impact once the pandemic is brought under control.”

cityairnews

cityairnews