Public sector banks must be given operational freedom: Former SBI chief

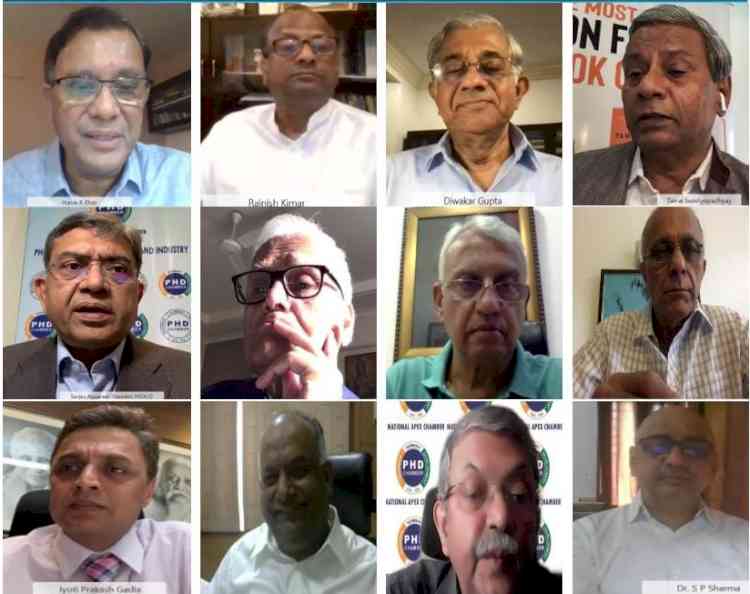

Interactive virtual session- ‘Privatization of Public Sector Banks- Open Issues, Challenges & Way Forward’ organized by PHDCCI

New Delhi: The public sector banks are one of the biggest contributors to nation-building and it needs to be freed of operational control for helping it achieve full efficiency, stated former State Bank of India chairman, Shri Rajnish Kumar at an interactive virtual session- ‘Privatization of Public Sector Banks- Open Issues, Challenges & Way Forward’ organized by the PHD Chamber of Commerce (PHDCCI).

Speaking at the event, Shri Kumar mentioned that at the moment, Public sector banks are under the supervision of two authorities namely the Reserve Bank of India and the Department of Financial Services. He stated that public sector banks play a very crucial role in shouldering the responsibility of initiating most of the government’s schemes for which it needs to be compensated rather than infusing fresh capital in it. He stated that the government needs to work on a compensation structure for public sector banks who are involved in implementing various government programs.

Shri Kumar stated that almost 51 years ago when there was an era of complete control, the government decided to nationalize banks to help them reach heights. He stated that the situation is completely different now. According to Shri Kumar, the government at present can no longer infuse fresh capital in the public sector banks and wants to concentrate its efforts on other sectors. The role can now be played by private sector entities that can help these public sector banks achieve desired targets.

According to Shri Kumar, the government is planning sweeping reforms in the year 2021 in the banking sector which is similar to what the earlier government did in the year 1990 with the liberalization of the Indian economy.

Mr. Harun Rashid Khan, Former Deputy Governor, Reserve Bank of India stated that due to fiscal stress on Banks, a lot of banks have failed even in the most advanced countries where the tax payer’s money has been used by the government to bail them out. There have been cases when around 6-10 percent of the GDP value has been used to bail out the banks, he said.

Mr. Khan pointed out that in India, the share has been around 1 percent but the fiscal stress has systematically been triggered in the last few years. He informed that rather than going into the debate of privatization of banks, one needs to undertake a SWOT analysis of both the public and private banking system.

According to Mr. Khan, the government was successful in implementing several of its programs only because of the participation of the public sector banks. Schemes like the Jan Dhan Yojana, where more than 40 crore bank accounts were opened for people living in the remotest parts of the country, the feat would not have been possible without the help of the public sector banks that has wider and deeper reach in the country, he added.

Mr Diwakar Gupta, Former Managing Director, State Bank of India and Former Vice President of the Asian Development Bank of India explained that it is not the case that the public sector banks have outlived its utility that the government is thinking of privatization of these banks. He explained that one of the biggest advantages of privatization of public sector banks is that the government’s goals would be served better as its resources can be put to better use in other priority sectors.

According to Mr. Gupta, public sector banks have lost a lot of capital that has been infused over the last several years rather than creating wealth for themselves as they are also involved in several of the government's social schemes. He also added that while there is a need to privatize some large public sector banks, the country equally needs public sector banks to operate efficiently at the regional level. He stated that a mix of both the public and private sector banks is the need of the hour.

He added that before the privatization of these banks, there is a need to create value in them. He also added that consolidation comes at a huge cost as the human resources in these banks cannot be redeployed due to union action.

Shri Sanjay Aggarwal, President, PHDCCI explained that the proposed privatization of the public sector banks is expected to be the only way that India’s public sector banks can be transformed into entities that are commercially viable. He added that it is also expected that privatization of these public sector banks will help in increasing efficiencies, compliance & risk mitigation.

According to Shri Aggarwal, Though, it is difficult to anticipate if the proposed privatization of the Public Sector Banks will yield the desired results of improving efficiency for the economy and gives a fillip to our banking sector; however, it will be interesting to see how this new phase will evolve in the country. He informed that once privatized, the government need not infuse further capital into these banks, which will help the government consolidate its fiscal position.

Shri Aggarwal also explained that the privatization of public sector banks will help in providing equitable access to finance for all, keeping financial services affordable, security for the depositors’ money, and finally the interest of the nation and its people.

cityairnews

cityairnews