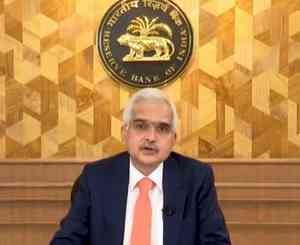

Rising consumption, robust investment demand to boost India's GDP: Shaktikanta Das

Reserve Bank of India (RBI) Governor Shaktikanta Das on Wednesday said the real GDP for FY25 is estimated to be 7.2 per cent, which is in line with global projections amid strong fundamentals, rising consumption and robust investment sentiment in the country.

New Delhi, Oct 9 (IANS) Reserve Bank of India (RBI) Governor Shaktikanta Das on Wednesday said the real GDP for FY25 is estimated to be 7.2 per cent, which is in line with global projections amid strong fundamentals, rising consumption and robust investment sentiment in the country.

Das estimated real GDP for Q2 FY25 at 7 per cent, Q3 at 7.4 per cent and Q4 at 7.4 per cent. Real GDP growth of Q1 of next year has been estimated at 7.3 per cent.

Speaking on the third and last day of the RBI's Monetary Policy Committee (MPC) meeting, Das said that the share of investment in the GDP has reached its highest level since 2012-13.

"Looking ahead, India’s growth story remains intact as its fundamental drivers - consumption and investment demand - are gaining momentum," said Das.

On the supply side, gross value added (GVA) expanded by 8 per cent, surpassing the GDP growth, aided by strong industrial and services sector activities.

"High-frequency indicators available so far suggest that domestic economic activity continues to be steady. The main components from the supply side - agriculture, manufacturing and services remain resilient," said the RBI Governor.

According to Das, agricultural growth has been supported by above-normal monsoon and better kharif sowing. He further stated that manufacturing activity is gaining on the back of improving domestic demand, lower input costs and a supportive government policy environment.

"Government consumption is improving, investment activity remains buoyant, government spending rebounding from a contraction in the first quarter, and private investment continues to gain steam," said the RBI Governor.

According to the central bank, household consumption is poised to grow faster in the second quarter of the current fiscal (FY25) as headline inflation eases, with a revival of rural demand already taking hold.

IANS

IANS