SBI General Insurance posts an impressive 273% PAT Growth in 9M FY25

SBI General Insurance, one of India's leading general insurance companies, has delivered a robust financial performance during the first nine months of FY25. The company reported a Profit After Tax (PAT) of INR 504 crore, reflecting an impressive year-on-year growth of 273%.

Bengaluru, January 20, 2025: SBI General Insurance, one of India's leading general insurance companies, has delivered a robust financial performance during the first nine months of FY25. The company reported a Profit After Tax (PAT) of INR 504 crore, reflecting an impressive year-on-year growth of 273%.

The company’s strong performance is evident across key financial indicators. Its gross written premium (GWP) rose by 10.9%. The gross direct premium (GDP) growth of 10.5% exceeded the industry growth rate of 7.8%. SBI General’s solvency ratio remains strong at 2.12 times, well above the regulatory minimum of 1.50, underscoring the company’s solid financial foundation.

SBI General Insurance’s impressive financial results in 9M FY25 was primarily driven by robust growth across key business segments. The Motor Insurance portfolio achieved an impressive year-on-year growth of 39%, supported by enhanced underwriting strategies and the successful expansion of digital channels for seamless policy issuance and renewals. The Health Insurance segment grew by 12% due to rising healthcare awareness, increased demand for comprehensive coverage, digital adoption, and government policies. The company's loss ratio improved significantly by ≈4% compared to 9M FY24 through better risk management, efficient claims processing, and data-driven strategies. These performance drivers underscore the company’s strategic focus on innovation and customer-centric solutions.

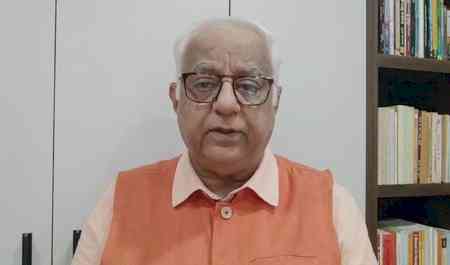

Commenting on the Company's performance, Naveen Chandra Jha, MD & CEO, SBI General Insurance, said "Our strong financial performance in 9M FY25 reflects our steadfast dedication to customer-focused innovation, operational excellence, and sustainable growth. The notable growth across our Motor, Health, and Engineering segments demonstrates our agility in responding to market trends and our commitment to delivering value to policyholders and stakeholders”

Jitendra Attra, CFO, SBI General Insurance, added: "Our consistent financial performance in 9M FY25 underscores disciplined underwriting practices, a collaborative team effort, and a strong focus on operational excellence. The significant increase in profitability and solvency highlights our robust business fundamentals and ability to foresee and adapt to a dynamic market environment. “

SBI General Insurance continues to build on its growth trajectory, leveraging a customer-centric approach, strong team collaboration, and a diversified product portfolio, all of which contribute to sustained profitability and a growing market presence.

City Air News

City Air News