SBI JV, SBI Payments to launch YONO SBI Merchant, complete Soft PoS solution

Join hands with Visa to offer Tap to Phone facility

Chandigarh: SBI Payments, the Subsidiary of State Bank of India (SBI), the country's largest bank is launching YONO Merchant App to expand the digitization of merchant payments in the country. Aiming to enable millions of merchants through mobile led technology to accept digital payments, SBI plan to deploy low-cost acceptance infrastructure across India over the next two years targeting 20 million potential merchants across India in Retail and Enterprise segment.

The launch is in line with RBI’s recent announcement of creating a Payments Infrastructure Development Fund (PIDF) to encourage acquirers to deploy Point of Sale (PoS) infrastructure (both physical and digital) in lesser penetrated areas of the country. Merchants will now be able to turn their NFC enabled Android smartphones into payment acceptance devices through a simple mobile app.

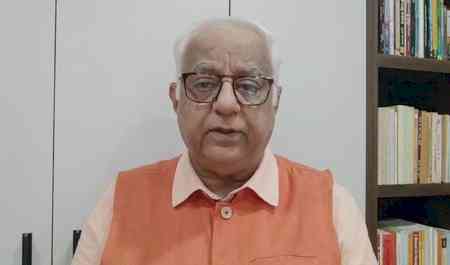

Speaking on the launch Shri Dinesh Kumar Khara, Chairman SBI said,” It gives me immense pleasure to announce the launch of YONO SBI Merchant app by our Digital Payments subsidiary SBI Payments. The Bank launched YONO Platform three years ago, YONO, has 35.8 million registered users. YONO Merchant is a brand extension of this platform aiming to improve user experience and bringing convenience to our merchants. In the next 2-3 years, we are aiming to digitize millions of merchants by upgrading their mobile phones into a PoS device accepting all form factors, accessing Value Added Services such as loyalty, GST invoicing, inventory management, etc and connecting into an interface to avail other banking products at a click of a button.”

On the launch, Shri Giri Kumar Nair, MD& CEO, SBI Payments said, “SBI Payments is at fore front of innovation bringing state of the art products for our customers. We are aiming to grow our merchant touch points multi fold crossing 5-10 million within 2-3 years. YONO SBI Merchant is a great enabler for retail & enterprise merchants offering a holistic product proposition to improve merchant engagement, user experience and convenience.

SBI partnered with Visa, on the Tap to Phone feature, which aims to give the necessary boost to scale up acceptance infrastructure across the country.

Speaking on the partnership, TR Ramachandran, Group Country Manager, India and South Asia, Visa said, “We are delighted to partner with SBI to digitally enable merchants, an essential part of the country’s payments ecosystem. The pandemic has highlighted the benefits of digital, less-touch payments to merchants and consumers alike. Our partnership with SBI is aimed at empowering more merchants with low-cost, innovative, simple and secure ways of accepting digital payments and forms an important part of our global commitment to digitally empower 50 million small businesses. We are confident that with SBI’s presence around the length and breadth of the country, millions of consumers in smaller cities will be able to pay digitally and conveniently at their nearby stores.”

With a number of consumers and merchants coming online, seamless and secure digital payment experiences are essential to ensure they continue using digital payments. While the State Bank of India has focused on providing innovative, best-in-class banking services and inclusion of new-to-digital merchants and customers, Visa continues to simplify payments with products like tokenization.

With India’s smartphone base expected to reach 820 million in the next two years, both SBI and Visa firmly believe there is a tremendous opportunity to augment them as payment acceptance devices. Following the deployment, merchants will also be able to access details of transactions, generate reports, upload transactions for processing etc. through SBI’s mobile application besides accepting payments on their mobile device. /(February 21, 2021)

cityairnews

cityairnews