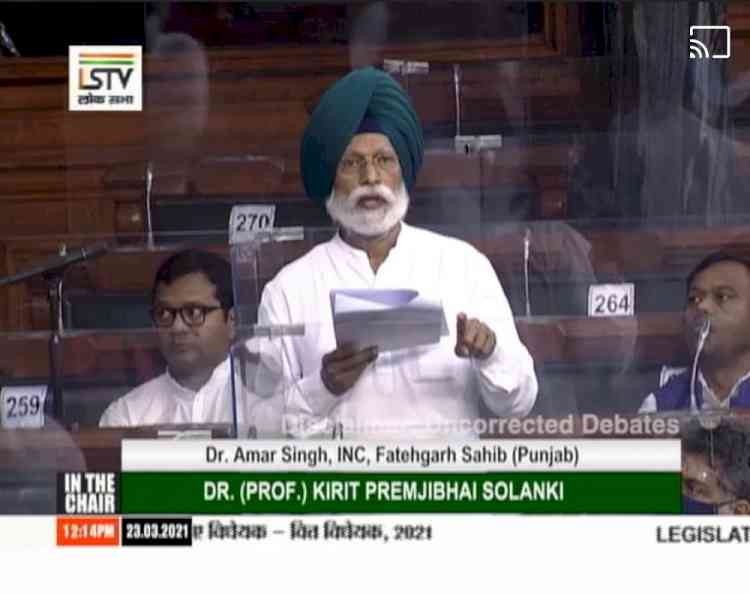

Why, tax relief only to the rich people: Amar Singh

Fatehgarh Saheb MP demands urban MNREGA, withdrawal of farm laws, mapping of Covid- induced losses in the informal sector

Raikot (Ludhiana): Opposition Congress opened the debate on the Finance Bill 2021 in the Lok Sabha accusing the government of offering tax relief only to the rich while burdening the poor and the middle class with repeated raise in petrol and diesel prices.

Initiating the debate, Fatehgarh Saheb MP Amar Singh urged Union Finance Minister Nirmala Sitharaman to withdraw the excise duty on petrol and diesel and roll back customs duty hikes on nuts, bolts, electronic toys and rail projects.

The Congress MP demanded urban MNREGA, withdrawal of farm laws and mapping of Covid-induced losses in the informal sector noting that the unorganised sector formed 60 per cent of the economy and employed lakhs of people and was the hardest hit by the pandemic.

“It is another matter if you have decided to punish the farmers who ensured that of the eight core sectors of the economy only agriculture grew during Covid times. Otherwise, you should withdraw the farm laws and raise budgets for agriculture which you have cut,” Singh said after the FM presented the Bill to seek the permission of the House to give effect to budget proposals for FY 2021-2022.

The Congress MP said the government waived Rs 1.5 lakh crore of corporate tax last year while the poor are being burdened with fuel price rise.

“Your tax collections have also reduced. You collected 1.25 lakh crore lesser GST in 2020-21; Rs 2.4 lakh crore lesser corporation tax while excise duty rose by Rs 1 lakh crore. Tax relief has been only for the rich. Rollback excise duty on fuel,” Singh said cautioning the government against the centralisation of taxes.

The MP said the government had raised cess and surcharge so much that 24 per cent of its revenue was now coming from these sources.

“But the Centre is not sharing this revenue with the states which have not even got their GST compensation. The states are heavily strained,” Amar Singh noted, referring to CAG’s observations on how cess revenues were hardly being used for the purpose they are levied.

The MP also doubted that the government could achieve its listed Rs 1.75 lakh crore of disinvestment target and demanded higher budgets for health, noting that the bracketing of the budget of several sectors under health would not help in Covid years.

“The Ministry of Health budget at BE 2020-21 stage was Rs 65,012 crore which you raised by Rs 13,000 crore at the revised estimate stage but again brought to Rs 71,269 crore in the BE for 2021-22. This must increase. Even the finance commission grants which you have shown under the health budget this year are meant for five years,” he said.

The MP flagged how private hospitals in Punjab fleeced people charging them up to Rs 15 lakh per patient during COVID and how the government health system came to the rescue of people.

Singh demanded higher wages for ASHAs who, he said, did a great job with contact tracing during COVID. The MP also demanded the restoration of the MPLADS scheme suspended due to COVID.

cityairnews

cityairnews